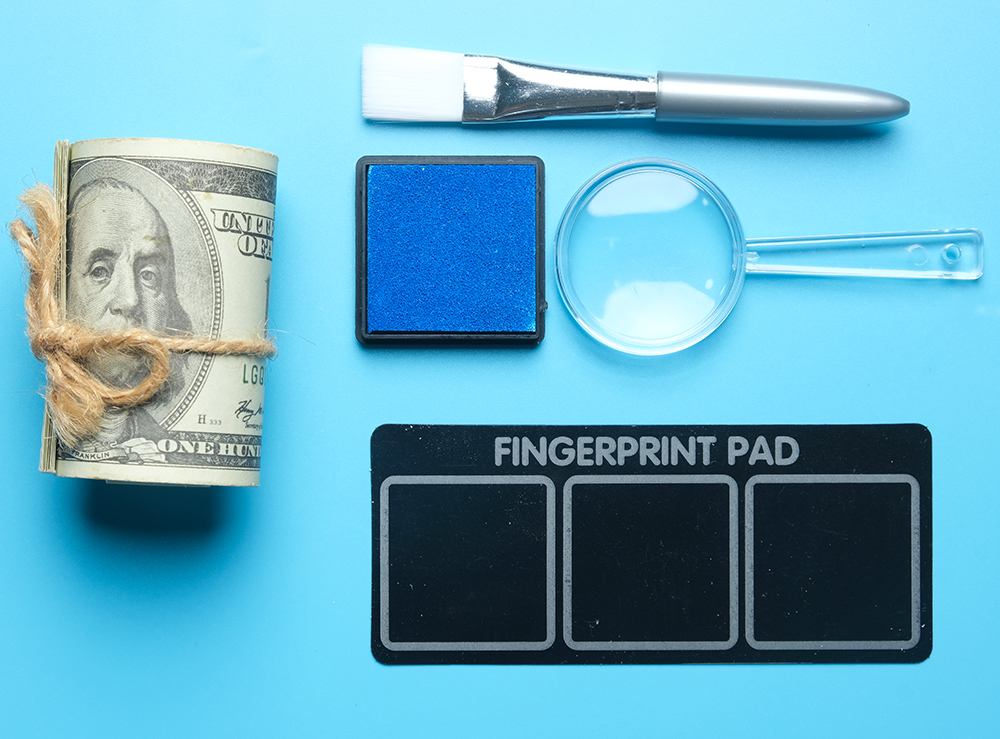

Forensic audits, also known as forensic accounting or investigative audits, are specialized audits conducted to investigate and uncover financial irregularities, fraud, or misconduct within an organization. These audits involve the application of accounting, auditing, and investigative techniques to examine financial records, transactions, and supporting evidence.

Forensic audits are typically performed in response to suspicions or allegations of fraud, embezzlement, misappropriation of assets, financial statement manipulation, or other financial misconduct. The objective of a forensic audit is to gather evidence, analyze financial data, and determine the extent of any wrongdoing or financial impropriety. The findings of a forensic audit can be used in legal proceedings, disciplinary actions, insurance claims, or dispute resolutions.

Here are some key aspects and procedures involved in forensic audits:

Fraud Detection and Prevention

Forensic audits aim to identify and prevent fraud by assessing internal controls, detecting red flags, and analyzing transaction patterns. This involves examining financial records, bank statements, invoices, receipts, and other supporting documents to identify irregularities or suspicious activities.

Data Analysis and Reconstruction

Forensic auditors utilize data analysis techniques to identify patterns, anomalies, and trends in financial data. They may use specialized software tools to analyze large volumes of data and reconstruct financial transactions to identify fraudulent activities or hidden assets.

Interviewing and Interrogation

Forensic auditors may conduct interviews with relevant individuals, including employees, management, and external parties, to gather information, clarify discrepancies, and obtain additional evidence. They may also utilize interrogation techniques to uncover hidden information or elicit admissions.

Asset Tracing and Recovery

In cases involving asset misappropriation or embezzlement, forensic auditors trace the flow of funds and assets to identify their current location or disposition. They may work with legal authorities or recovery specialists to seize or recover misappropriated assets.

Document Examination and Forensic Accounting Techniques

Forensic auditors examine financial documents, contracts, agreements, and other records to verify their authenticity, identify alterations, or detect forged documents. They may employ forensic accounting techniques, such as income reconstruction, cash flow analysis, and asset valuation, to uncover hidden financial transactions or assets.

Expert Witness Testimony

Forensic auditors may provide expert witness testimony in legal proceedings, arbitration, or dispute resolutions. They present their findings, interpretations, and opinions based on their investigation to assist the court or relevant parties in understanding complex financial matters.

Compliance and Regulatory Investigations

Forensic audits may be conducted to assess compliance with legal and regulatory requirements, such as anti-money laundering regulations or bribery and corruption laws. These audits help identify any breaches, assess the impact, and recommend corrective actions.

It’s important to note that forensic audits require specialized knowledge, skills, and experience in both accounting and investigative techniques. Forensic auditors often work closely with legal professionals, law enforcement agencies, or internal investigation teams to gather evidence and support legal proceedings, if necessary.

The scope and procedures of a forensic audit can vary depending on the nature and complexity of the suspected financial misconduct. The primary focus is on uncovering evidence, determining the extent of the wrongdoing, and providing a clear and unbiased analysis of the financial irregularities or fraudulent activities.

LOB provide this service by highly qualified and competent professionals.